We Are Where You Are!

At Security Bank, we believe that financial empowerment begins with education. That's why we're committed to providing you with the tools and resources necessary to take control of your financial future. Here you'll find tips and resources designed to empower you on your financial journey. Discover the possibilities that await you!

Online Banking Login Guide

- Navigate to securitybankkc.com using one of the supported browsers. Visit our Supported Browsers page and download the correct browser for you.

- Select the "Login" button located in the upper right-hand corner of our home page. If you have not enrolled in Online Banking, you can do so by filling out our New User Enrollment form. Follow the prompts to create a username and password for your Online Banking access.

- Type in your Username, this can be the alias you created or your Online Banking identification number starting with 7227. When you are finished, click "Login".

- If you do not remember your login information, you can click “Forgot Password?”. You will be directed to input your Social Security Number, EIN or ITIN as well as your account number.

Click Next once you have typed the information into all the fields. Verification to recover this information will then be sent to the email on file with Security Bank of Kansas City.

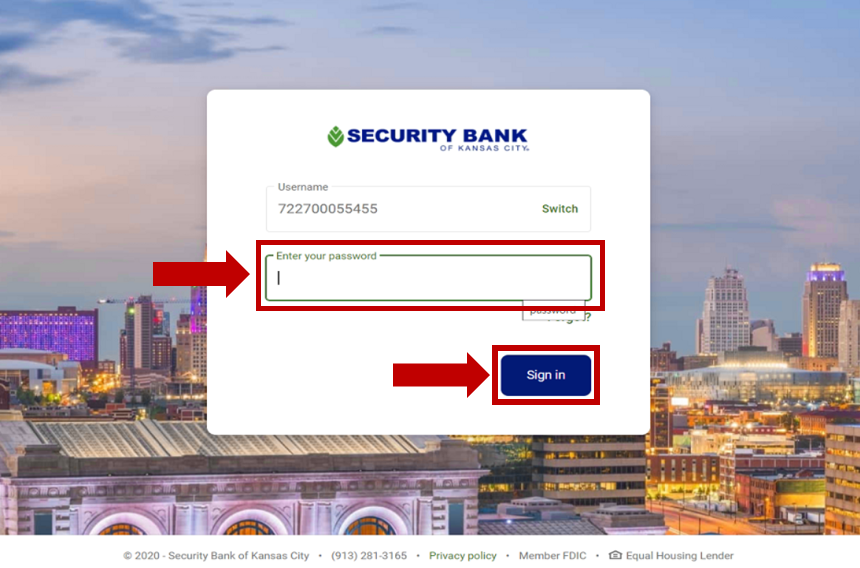

- Enter your Password, then click "Sign in".

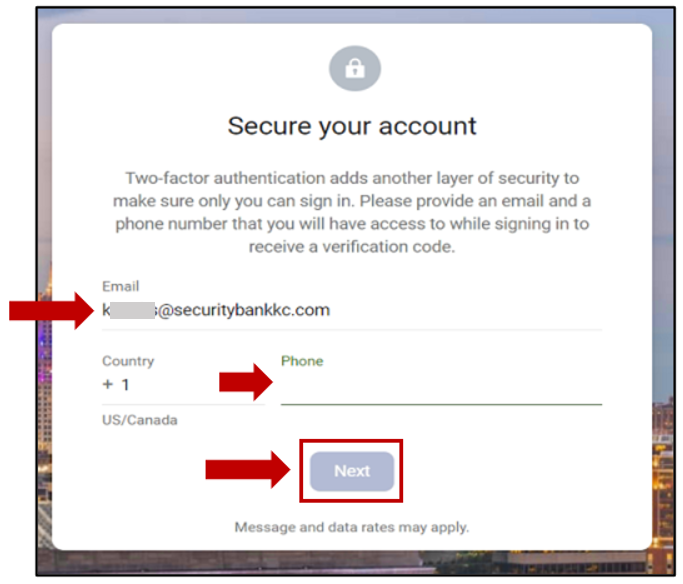

- For an extra layer of security on your account, consider adding Two-Factor Authentication (2FA).

In the appropriate fields, enter in your full email address and your 10-digit phone number, then click "Next".

Helpful Tips:-

- Remember to type out your full email address by adding the @ symbol and the .com.

- DO NOT enter a country code if you have a U.S. or Canadian phone number.

- To receive your account code (2FA) via text message, enter your mobile phone number.

- To receive an account code (2FA) via a phone call, enter a telephone number.

Verify your login credentials through:

-

- A text message

- A phone call

-

-

-

When you have selected your option, click "Next".

-

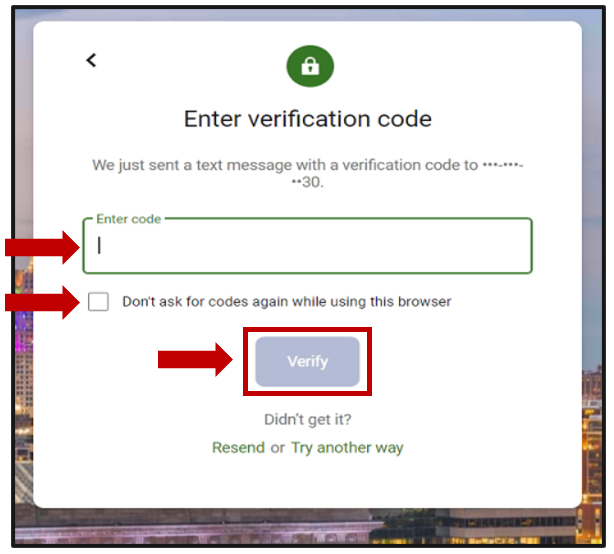

When you receive your verification code by text message or phone call, type it into the Enter Code field.

Selecting “Don’t ask for codes again while using this browser” will allow the computer to remember you, so you will not receive a verification code again unless you clear your cookies or cache. - When complete, click "Verify".

Helpful Tips:-

- Codes sent through text messages or phone calls will expire after 2 minutes.

- If your authorization code does not arrive within a few minutes, select one of the following options:

- “Resend” to have a code sent again through the same path.

- “Try another way” to select a different path to send the code.

-

-

You’re all set!

Click "Ok" to see your new Online Banking dashboard. You can download and print this guide by clicking the button below.If you have questions or need further assistance, please contact Customer Support at (913) 281-3165.

You can download and print this guide by clicking the button below.If you have questions or need further assistance, please contact Customer Support at (913) 281-3165.

Mobile Banking Tools

Mobile Banking puts Security Bank in the palm of your hand! Our app is so robust you’ll be wondering what it can’t do!

Customizable Dashboard

Easily feature the information that’s most important to you.

Enhanced Security Features

Two-factor authentication (2FA) helps protect your account from unauthorized access.

Secure Conversations

Chat with our Customer Support Team to get the answers you need.

Debit Card Controls

Lock and unlock your Debit Mastercard® or report it lost or stolen.

Budgeting Tools

Tag, search, categorize, download, and add notes to your transactions. View check images and add receipts for recordkeeping.

Bill Pay

Set up and manage payments. You can even add a rush payment!

Pay a Person

Send and receive money with friends and family.

Mobile Deposit

Deposit checks using your phone’s camera.

Locator Feature

Find the Banking Center or ATM nearest you.

Set Up Account Alerts

Secure Conversations

Chat with our Customer Support Team to get the answers you need.

Debit Card Controls

Lock and unlock your Debit Mastercard® or report it lost or stolen.

Budgeting Tools

Tag, search, categorize, download, and add notes to your transactions. View check images and add receipts for recordkeeping.

Bill Pay

Set up and manage payments. You can even add a rush payment!

Pay a Person

Send and receive money with friends and family.

Mobile Deposit

Deposit checks using your phone’s camera.

Locator Feature

Find the Banking Center or ATM nearest you.

Set Up Account Alerts

Receive notifications for large dollar transactions, low balance, or other important activity.

Travel Notifications

Travel Notifications

Help us know your card is with you when you travel.

Desktop Online Banking Tools

Online Banking puts Security Bank on your desktop!

Customizable Dashboard

Easily feature the information that’s most important to you.

Quicken Compatible

Download transactions and upload them to Quicken.

Enhanced Security Features

Two-factor authentication (2FA) helps protect your account from unauthorized access.

Secure Conversations

Chat with our Customer Support Team to get the answers you need.

Debit Card Control

Lock and unlock your Debit Mastercard® or report it lost or stolen.

Budgeting Tools

Tag, search, categorize, download, and add notes to your transactions. View check images and add receipts for recordkeeping.

Bill Pay

Set up and manage payments. Add a rush payment!

Pay a Person

Send and receive money with friends and family.

Locator Feature

Find the Banking Center or ATM nearest you.

Set Up Account Alerts

Secure Conversations

Chat with our Customer Support Team to get the answers you need.

Debit Card Control

Lock and unlock your Debit Mastercard® or report it lost or stolen.

Budgeting Tools

Tag, search, categorize, download, and add notes to your transactions. View check images and add receipts for recordkeeping.

Bill Pay

Set up and manage payments. Add a rush payment!

Pay a Person

Send and receive money with friends and family.

Locator Feature

Find the Banking Center or ATM nearest you.

Set Up Account Alerts

Receive notifications for large dollar transactions, low balance, or other important activity.

Travel Notifications

Travel Notifications

Help us know your card is with you when you travel.

How does my dashboard work?

After successfully signing in, you will see your “Dashboard”. A list of your accounts will be presented at the top. To view all accounts on one screen, select “View all". Below your account listing, "Quick Actions" are presented (Transfer, Pay, Deposit, Message). Under the “Quick Actions” icon you will find Transactions, Payments, Transfers, Card management, etc.

Can I reorganize my dashboard?

Yes! At the bottom of the dashboard, click “Organize dashboard” to drag and drop, delete or add information. The dashboard activity displays transactions from all your accounts. To find account specific information, click “Transactions” for the specific account you want to review.

How do I set up an account alert?

Select the account you would like to add an alert to and then select “Alert preferences”. You may set up balance or transaction alerts based on low or high thresholds. Receive alerts by email, text or within the app.

Why are transactions labeled as pending?

Transactions appear as pending until final processing occurs.

Can I view my statements?

Yes. To view your statements, choose the account you’d like to review and select “Documents”. If you are currently not signed up to receive electronic statements, you have the option to enroll at the top of the screen.

Bill Payment, Transfers & Loan Payment

Transfers

How do I transfer money between my Security Bank of Kansas City accounts?

Select the "Transfer" icon and choose the accounts you want to transfer "From" and "To". Only eligible accounts will be listed. While the transfer between your accounts will take place immediately, transfers completed after 10:00PM may be processed during the next business day.

What are the cutoff times for transfers between my Security Bank of Kansas City accounts?

The cutoff time for same-day transfers is 10:00PM, Monday - Friday. Transfers conducted during a weekend or bank holiday will process the next business day.

Can I add a memo line to a transfer?

A memo line can be added to an immediate transfer. It cannot be added to recurring or future-dated transfers.

Why am I unable to add a memo to recurring or future-dated transfers?

Memos are not an option for recurring or future-dated transfers; however, you can add a “tag” to transactions that will appear after the transfer posts to your account.

Loan Payments

How do I make a loan payment?

Select the "Transfer" icon and choose the account from which to make your payment. Select the loan account. To schedule a recurring payment, choose “More Options” to select frequency and date. Transfers completed after 10:00PM will be processed on the next business day.

Can I set up automated loan payments?

To schedule a recurring payment or a future-dated payment, choose “More Options” to select frequency and date.

How can I view an estimated payoff for my loan?

An estimated payoff is shown in the Account Details. This payoff estimate may not include additional fees and other charges that have accrued, such as escrow. For a final payoff amount, please contact Customer Support at (913) 281-3165.

Debit Card Controls

What controls are available for managing my debit cards?

Under "Card management" on your Dashboard, you will have more access and control for your debit card:

-

- Report a card lost or stolen

- Lock and unlock your debit card

- Add and remove travel notices

How do I report a lost or stolen card?

To report a lost or stolen card, log in to your Online Banking account and click on the applicable card in the “Card management” section of your Dashboard. Select "Report card lost/stolen" and indicate the appropriate option.

Can I lock my debit card from being used for a period of time?

Yes. Within "Card management", select the card you want to lock and toggle the switch. Transactions will be denied, but recurring payments may continue. Any credits or deposits to the card will also be allowed.

Mobile Banking & Mobile Deposit

Are there device requirements to access the Security Bank of Kansas City Mobile App?

Yes, the Mobile App is compatible with iPhone and iPad devices running iOS version 11 or newer, and Android phones and tablets with version 6.0 or newer. Devices must have access to the internet.

How much does the Security Bank of Kansas City Mobile App cost?

There are no fees to download and use the Mobile App; however, connectivity and usage rates may apply. Contact your wireless service provider for more details.

Do I use the same user ID and password for the mobile app as I would for Online Banking?

Yes, you will use the same user ID and password that you use to log in to Online Banking.

If I forgot my password, can I reset it within the app?

Yes, you can easily reset your login credentials by clicking on the "Forgot?" link on the Mobile App.

How do I sign out of the Mobile App?

You will automatically be signed out once you swipe or close the app. Each time you access the app, you will be required to enter your passcode, use your fingerprint, or utilize the facial recognition feature in order to log in again.

Can I pay bills or a person in the app?

Yes, you can easily add payees, edit payees, and submit payments using the app.

Is there a fee to use Mobile Deposit?

No, conducting a Mobile Deposit using the Security Bank of Kansas City Mobile App is free.

Are there any limitations with using Mobile Deposit?

Yes, there are daily and monthly limitations to the number and dollar amounts that can be deposited through a mobile device. Contact Customer Support at (913) 281-3165 for specific details. Click here for more details about Mobile Deposit.

Cash Management User FAQ

How do I manage my users?

To manage users, click on the "Cash Manager" tab in the menu option. From there you’ll see the screens to manage your users. Simply click on the "Dashboard" tab to go back to viewing account balances and transaction information.

How do I initiate an ACH template?

There is a feature in the menu options titled "Approve ACH" to initiate an existing ACH batch that does not require changes to the dollar amount of the batch. Should you need to make changes to the dollar amounts, click on the "Cash Management" tab in the menu option. From there you’ll see the screens to initiate and manage your ACH transactions. Simply click on the "Dashboard" tab to go back to viewing account balances and transaction information.

How do I initiate a Wire Transfer?

There is a feature in the menu options titled "Approve Wire" to initiate and approve a wire transfer template or to approve a wire transfer once it has been initiated if it is a new beneficiary or one-time wire. Should you need to add a new beneficiary, edit an existing template, or initiate a one-time wire, click on the "Cash Management" tab in the menu option. From there you’ll see the screens to initiate new wire transfers or edit your existing templates. Simply click on the "Dashboard" tab to go back to viewing account balances and transaction information.

How do I upload a Positive Pay file and decision Positive Pay exception items?

To access Positive Pay functions, click on the "Cash Management" tab in the menu option. From there you’ll see the screens to manage Positive Pay. Simply click on the "Dashboard" tab to go back to viewing account balances and transaction information.

I don’t see a Bill Pay option on my Dashboard. How do I access my Business Bill Pay?

To access Business Bill Pay, click on the "Cash Management" tab in the menu option. From there you’ll see the "Bill Pay" tab to process payments. Simply click on the "Dashboard" tab to go back to viewing account balances and transaction information.

Adding Additional User IDs/Online Banking Accounts

If I have multiple Online Banking accounts will I have to log in to each account with the usernames and passwords for each account separately?

With our new Mobile App, you can sign into multiple user profiles and quickly switch between them using a PIN instead of entering a username and password. If you add more profiles to your Mobile App, you will need to set up two-factor authentication (2FA) for each of them.

How do I add additional login profiles to my Mobile App?

How do I switch between profiles on my Mobile App?

-

- From the top of the menu bar, select the person icon next to your profile name.

- Select "Add profile".

- Sign in to the second profile.

- If prompted, answer the security question. If not, continue to the next step.

- If prompted, complete the profile information in the form, and then select "Done".

- Enter a PIN for the new profile.

- Confirm the PIN for the new profile.

-

- From the top of the menu bar, select the switch icon next to your profile name.

- Select the profile and log in.

- Enter the PIN or use the biometric authentication when prompted.

2-Factor Authentication FAQ

Two-Factor Authentication (2FA)

Two-Factor Authentication (2FA) is a security feature that helps safeguard your account information. To implement 2FA, you will need to enroll an email address and a phone number (mobile or landline). Once this information is entered, you’ll choose one of two options to receive a one-time verification code:

-

- Text message to the mobile phone entered, or

- Automated phone call to phone number entered.

How does the phone call verification process work?

If you select to receive a phone call (cell phone or landline), you will enter a single specific digit, as directed, before the verification code is provided.

If you fail to answer the authentication phone call, you will need to select the option to have the code re-sent. The system will not leave codes on voicemail.

Note: The phone number used to send the verification code may not always be the same phone number but will always be sent from a US-based phone number.

What should I do if I did not receive a verification code to continue with the two-factor authentication enrollment?

Please be sure the phone number you entered is correct. If it needs to be changed, contact our Customer Support Team at (913) 281-3165 during regular banking hours.

How much time do I have to enter the verification code?

Codes will expire within three minutes.

Can I lock myself out by entering an incorrect verification code?

Yes. You can get locked out of the enrollment process if too many attempts are made with an incorrect verification code (more than six times in a single hour). You must wait an hour to try again following your first attempt. If you make more than 20 unsuccessful attempts in a 24-hour period, your login will be 'Suspended' and you will not be able to attempt again for 24 hours. If you have questions or need additional assistance, please contact Customer Support at (913) 281-3165 during our regular banking hours.

If I selected “Remember this computer,” why am I being asked for a verification code each time I log in?

There are several reasons you may be prompted for a verification code. This may include:

- Logging in using different browsers

- Deleting your browser history

- You have set your browser settings to delete your cookies and history automatically

Can I receive the two-factor authentication verification code via email?

No, codes sent by email are not available, but can be received using one of the following options:

- Text message

- Phone call

How can I reset my two-factor authentication enrollment?

You can reset your own two-factor authentication enrollment in both the app and online by going to your Profile page, then select "Security" within Settings.